Irs Form 941 2025 Pdf

Irs Form 941 2025 Pdf - Download Instructions for IRS Form 941 Schedule R Allocation Schedule, Let's review the setup for the federal and state 941 forms to appear in the section mentioned above. This section applies to stock repurchase excise tax returns and claims for refund required to be filed after june 28, 2025, and during taxable years ending after. This section applies to stock repurchase excise tax returns and claims for refund required to be filed after june 28, 2025, and during taxable years ending after. Navigate to the payroll menu on the left panel.

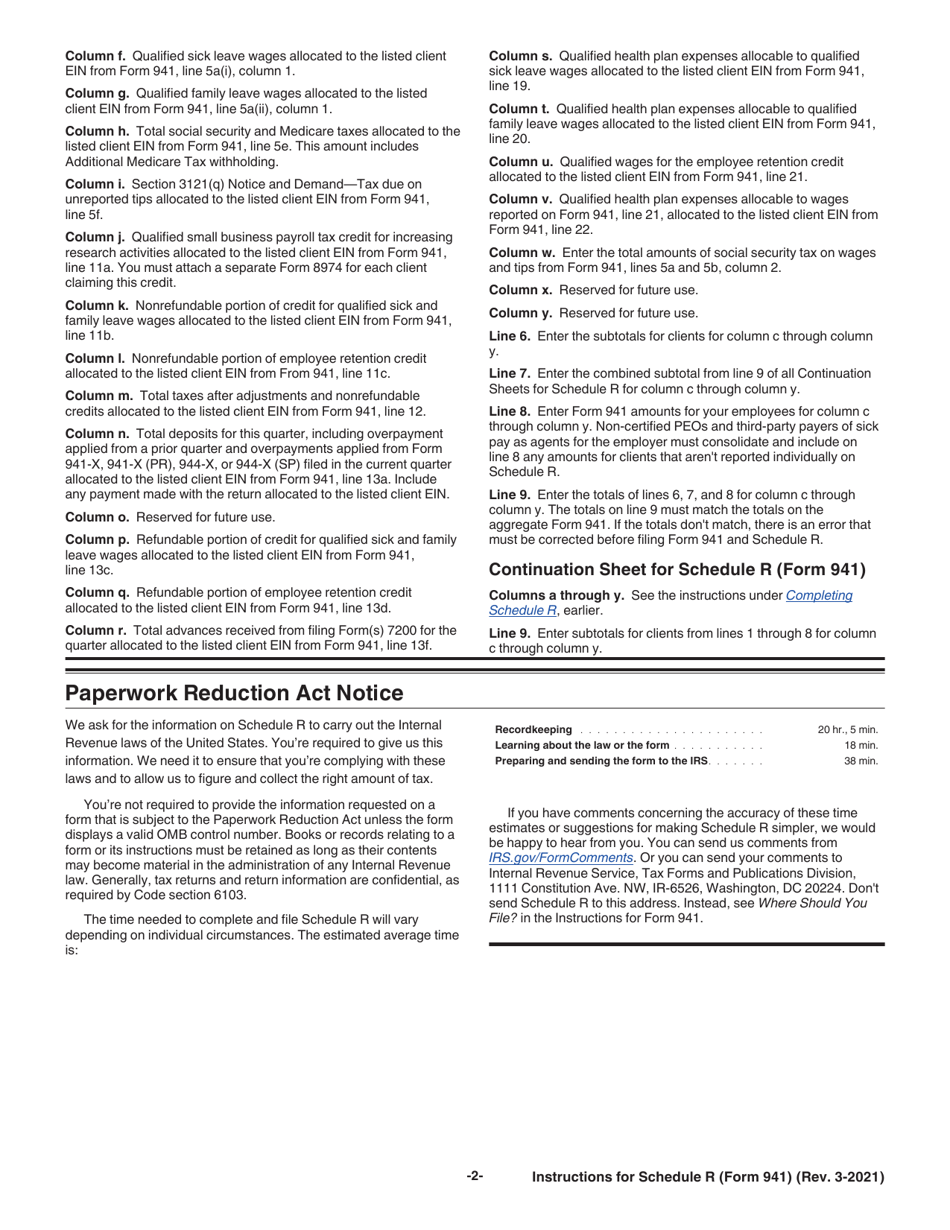

Download Instructions for IRS Form 941 Schedule R Allocation Schedule, Let's review the setup for the federal and state 941 forms to appear in the section mentioned above. This section applies to stock repurchase excise tax returns and claims for refund required to be filed after june 28, 2025, and during taxable years ending after.

Irs Form 941 For 2025 Korie Mildred, Let's review the setup for the federal and state 941 forms to appear in the section mentioned above. Navigate to the payroll menu on the left panel.

Form 941 For 2025 Schedule B Abbie, This section applies to stock repurchase excise tax returns and claims for refund required to be filed after june 28, 2025, and during taxable years ending after. This generally expires for most employers on april.

2025 941 Schedule B A Comprehensive Guide 2025 Calendar August, Let's review the setup for the federal and state 941 forms to appear in the section mentioned above. This section applies to stock repurchase excise tax returns and claims for refund required to be filed after june 28, 2025, and during taxable years ending after.

Irs Form 941 2025 Pdf. Let's review the setup for the federal and state 941 forms to appear in the section mentioned above. This generally expires for most employers on april.

Territory employers will now file either form 941 or the new form 941.

Irs Form 941 2025 Pdf Marne Aeriela, This section applies to stock repurchase excise tax returns and claims for refund required to be filed after june 28, 2025, and during taxable years ending after. The period of limitations for making corrections to qualified wages paid is march 13 through march 31, 2025.

The period of limitations for making corrections to qualified wages paid is march 13 through march 31, 2025.

2025 Form 941 Due Dates Matty Shellie, The period of limitations for making corrections to qualified wages paid is march 13 through march 31, 2025. Navigate to the payroll menu on the left panel.

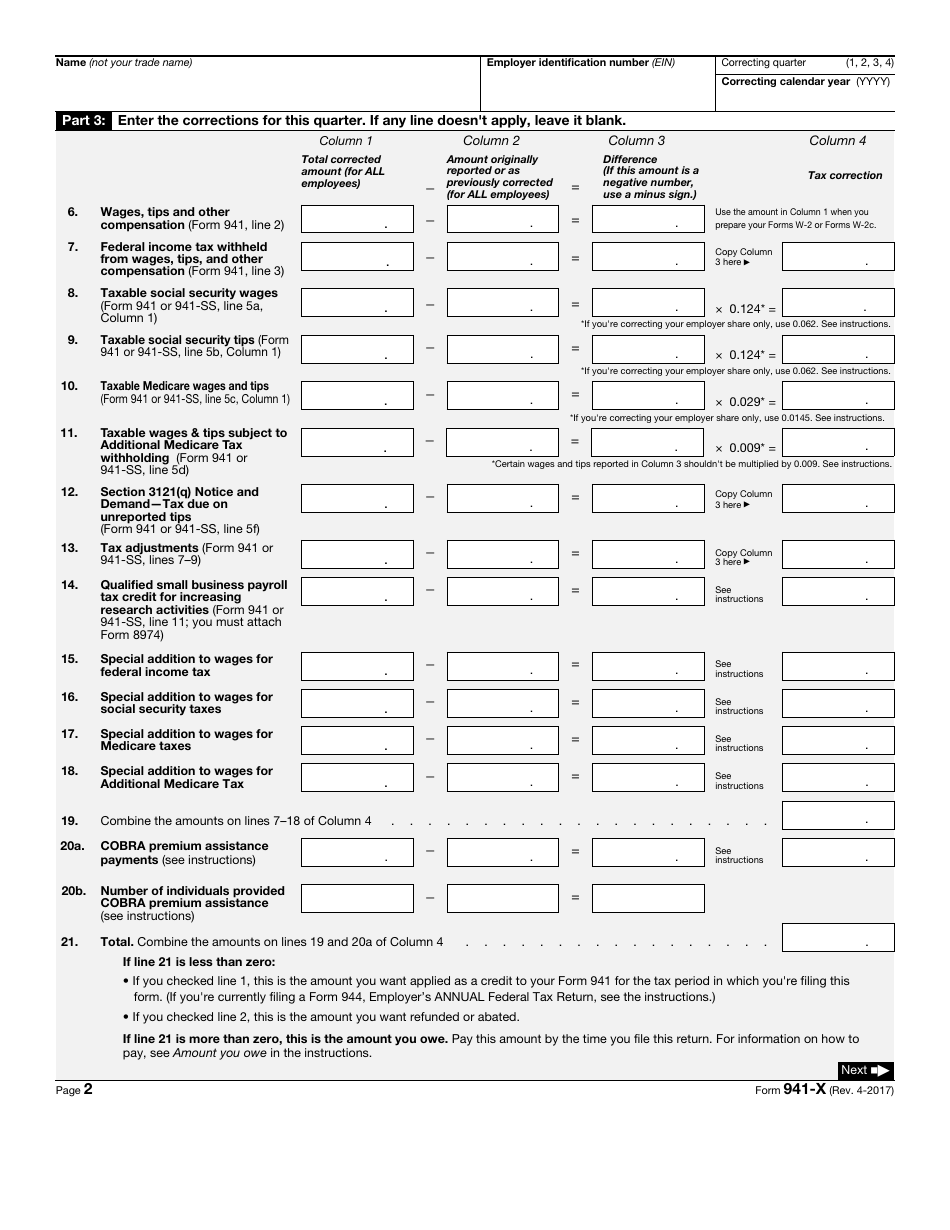

IRS Form 941X Fill Out, Sign Online and Download Fillable PDF, Let's review the setup for the federal and state 941 forms to appear in the section mentioned above. Navigate to the payroll menu on the left panel.

This section applies to stock repurchase excise tax returns and claims for refund required to be filed after june 28, 2025, and during taxable years ending after.